Introduction

Statistical methods are the unsung heroes of the finance world. They play a pivotal role in decision-making, risk assessment, and financial modeling. Imagine being a financial analyst without the ability to crunch numbers or interpret data. Sounds like a recipe for disaster, right? In finance, statistical methods help professionals make sense of complex data and provide actionable insights. They are the trusty sidekicks that ensure decisions are backed by solid evidence rather than hunches. As technology evolves, so do the statistical techniques used in finance. In 2024, advancements in data analytics and machine learning are changing the landscape. With the explosion of big data, finance professionals must adapt to new statistical methods that can handle vast quantities of information. Traditional techniques are being supplemented—or even replaced—by innovative approaches that allow for more nuanced analysis and real-time decision-making. This guide aims to equip finance professionals with the statistical methods relevant to their roles. It will cover foundational concepts, key tools, and advanced techniques, all designed to enhance analytical skills. Whether you’re a seasoned financial analyst or a newcomer navigating this complex field, this guide will help you sharpen your toolkit and improve your performance. Strap in, because we’re about to embark on an enlightening journey through the statistical methods that will shape the finance sector in 2024.

Statistical Foundations in Finance

Understanding Basic Statistics

Statistics is not just a collection of numbers; it’s a way to understand and interpret the world around us. In finance, understanding basic statistics is crucial. Let’s break it down into two main categories: descriptive and inferential statistics. Descriptive Statistics provide a summary of data. Think of it as the appetizer before the main course. It includes measures like mean, median, mode, and standard deviation.- Mean is the average value, calculated by summing all values and dividing by the count. It’s great for understanding overall trends.

- Median offers the middle value in a dataset, ensuring that outliers don’t skew the picture.

- Mode tells you which value appears most frequently, useful for spotting trends in consumer behavior.

- Standard deviation measures the amount of variation or dispersion in a set of values. A low standard deviation indicates that data points tend to be close to the mean, while a high standard deviation suggests they are spread out.

- Hypothesis testing helps determine if there is enough evidence to support a particular assumption about a dataset. For instance, if a company wants to assess whether a new marketing strategy has improved sales, they can test that hypothesis statistically.

- Confidence intervals provide a range of values that likely includes the population parameter. This helps quantify uncertainty and aids in decision-making.

Key Statistical Tools for Finance

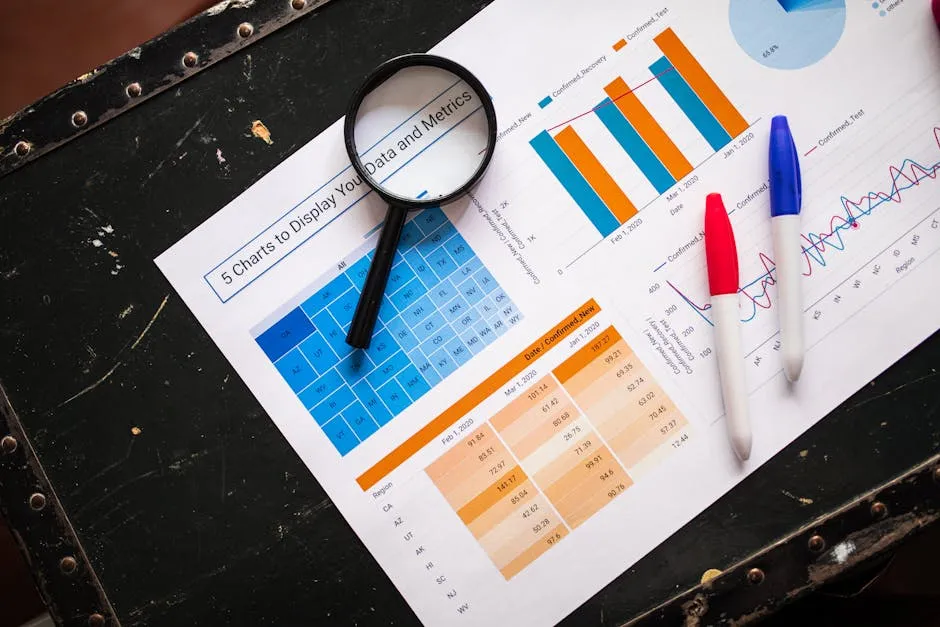

In the fast-paced world of finance, having the right statistical tools can make all the difference. Let’s look at some common tools and software recommendations that every finance professional should consider.Common Tools

Excel remains the classic choice. It’s like the Swiss Army knife of financial analysis. With its pivot tables and extensive formulas, Excel helps financial analysts manipulate data and create models that inform decision-making. Then there’s R. This programming language shines in statistical computing and graphics. It’s great for data analysis and visualization. R offers a plethora of packages tailored specifically for finance, making it a favorite among data scientists. Python is another heavy hitter. Known for its simplicity and readability, Python is perfect for automation. With libraries like Pandas and NumPy, finance professionals can handle large datasets with ease. Plus, it’s excellent for building predictive models and conducting advanced analyses. If you’re looking to get started with Python, check out Python Crash Course. It provides a hands-on, project-based introduction to programming that’s perfect for beginners!Software Recommendations

When it comes to software for statistical analysis in finance, the options are robust. Here are some popular choices:- Tableau: This tool excels in data visualization. It allows finance professionals to create interactive dashboards that make complex data easy to understand. If you’re interested in learning how to leverage Tableau, consider Tableau 2021 for Beginners.

- Power BI: Another strong contender in the visualization space, Power BI integrates well with other Microsoft products. It’s perfect for real-time analytics and reporting. You can find great resources to learn it, like Power BI for Dummies.

- SAS: Known for advanced analytics, SAS is widely used for data management and predictive analytics. Finance professionals use it for risk analysis and forecasting.

Advanced Statistical Techniques

Now, let’s venture into the advanced techniques that can elevate your financial analysis game. These methods, including regression and time series analysis, are vital for making informed, data-driven decisions.Regression Analysis

Regression analysis is a powerful statistical method for understanding relationships between variables. It helps in predicting outcomes based on historical data. If you’re looking for a comprehensive guide on regression and other statistical methods, I recommend The Basics of Financial Econometrics. It’s a fantastic resource that covers essential tools, concepts, and applications.Types of Regression

- Simple Linear Regression: This type involves one independent variable predicting a dependent variable. For example, predicting a company’s future sales based on past sales data.

- Multiple Regression: Here, multiple independent variables influence a dependent variable. Think about predicting stock prices based on various factors like interest rates, earnings reports, and market trends.

- Logistic Regression: This method is used when the dependent variable is categorical. For instance, it can help assess whether a client is likely to default on a loan (yes/no).

Applications in Finance

Regression analysis finds numerous applications in finance. Analysts use it to predict stock prices, assess risk, and evaluate investment strategies. By understanding relationships between variables, finance professionals can make informed decisions about portfolio management and risk mitigation.

Time Series Analysis

Time series analysis is the study of data points collected or recorded at specific time intervals. It’s crucial in finance for forecasting economic trends.Concept Overview

Understanding time series data is essential for predicting future movements based on historical patterns. Analysts use this method to spot trends, cycles, and seasonal variations.Techniques

- ARIMA Models: AutoRegressive Integrated Moving Average models are commonly used for forecasting. They help in understanding and predicting future points in a series.

- GARCH Models: Generalized Autoregressive Conditional Heteroskedasticity models are used for modeling volatility in financial markets. They help in assessing risk and pricing derivatives.

Applications

Time series analysis is vital for tasks such as economic forecasting, risk management, and analyzing market trends. By utilizing ARIMA and GARCH models, finance professionals can better understand market dynamics and make informed predictions about future performance. Incorporating these advanced statistical techniques into your analytical toolkit can significantly enhance your decision-making capabilities. Whether you’re predicting stock prices or assessing risk, mastering regression and time series analysis is a must for finance professionals in 2024.

Monte Carlo Simulation

Introduction

Monte Carlo simulation is a statistical technique used to model and analyze complex systems. Imagine trying to predict the stock market’s future or assess the risk of an investment. That’s where Monte Carlo comes in, acting like a crystal ball but with a bit more math. This method uses random sampling and repeated trials to simulate a range of possible outcomes. In finance, it’s a powerful tool for risk management, enabling analysts to understand uncertainty and variability in investments. Its significance in finance lies in its ability to provide insights into potential risks and returns. By simulating various scenarios, finance professionals can make informed decisions based on a comprehensive understanding of possible outcomes, rather than relying solely on historical data.Real-world Applications

Monte Carlo simulations are widely used in risk management. For instance, banks might use this method to assess credit risk by simulating various economic conditions to see how they affect loan defaults. Similarly, investment firms can simulate portfolio performance under different market conditions, helping them optimize asset allocation strategies. Another application is in portfolio optimization. By simulating thousands of portfolio combinations, financial analysts can identify the mix of assets that maximizes returns while minimizing risk. This approach allows for a more nuanced understanding of how different investments interact with one another, providing a roadmap for building resilient investment strategies.

Statistical Arbitrage

Definition

Statistical arbitrage is a sophisticated trading strategy that leverages statistical models to identify mispriced assets. It’s like being a financial detective, hunting for pricing discrepancies between related securities. Traders use historical data and statistical analysis to spot opportunities for profit, often executing trades at lightning speed to capitalize before the market corrects itself. This method is particularly relevant for hedge funds and proprietary trading firms, where speed and precision are crucial. By employing advanced algorithms, these professionals can identify trends and correlations in real-time, allowing them to make split-second decisions.Techniques

- Pairs trading involves identifying two correlated assets. When the price of one asset diverges from the other, traders buy the undervalued asset and short the overvalued one. This strategy profits when the prices converge, effectively betting on the relationship rather than the market direction.

- Mean reversion strategies operate on the premise that asset prices tend to revert to their historical averages. Traders using this technique will buy assets that have fallen below their average price, anticipating a bounce back. Conversely, they may short assets that have risen above their average, expecting a decline.

Emerging Statistical Trends for Finance Professionals

Data-Driven Decision Making

Role of Big Data

Big data is revolutionizing how financial professionals approach statistical analysis. With vast amounts of data generated daily, the ability to analyze and derive insights from this information is crucial. Financial institutions now have access to real-time data on market trends, consumer behavior, and economic indicators. This shift necessitates that finance professionals adapt their skill sets. An understanding of data analytics tools is no longer optional; it’s essential. The ability to sift through large datasets and identify actionable insights can set professionals apart in a competitive job market.Machine Learning and AI

The integration of machine learning and AI into finance is a game-changer. These technologies enable predictive analytics, allowing finance professionals to forecast trends and identify risks more accurately. For example, machine learning algorithms can analyze historical stock performance and predict future movements based on patterns. Additionally, AI can automate complex analyses, freeing up valuable time for finance professionals to focus on strategic decision-making. As these technologies continue to evolve, they will play an increasingly important role in shaping financial strategies and enhancing decision-making processes. If you’re looking for a solid introduction to machine learning in finance, consider Machine Learning for Finance. In conclusion, the landscape of finance is rapidly changing, driven by advancements in statistical methods, big data, and AI. Embracing these trends will not only enhance analytical capabilities but also position finance professionals for success in an ever-evolving industry.

Practical Applications

Case Studies

Successful companies are leveraging statistical methods to enhance their financial operations. Take XYZ Corp, for example. They implemented advanced regression analysis to optimize their investment portfolio. By analyzing historical data, they identified the best-performing assets and adjusted their strategy accordingly. The result? A significant increase in returns, proving that data-driven decisions lead to financial success. Another case study involves ABC Financial Services. They adopted Monte Carlo simulations to assess risk in their investment strategies. By running thousands of simulations, they gained insights into potential outcomes under various market conditions. This approach allowed them to fine-tune their risk management strategies, effectively minimizing losses during market downturns. These examples highlight how statistical methods can drive success in finance.

Lessons Learned

What can finance professionals learn from these case studies? First, the importance of data-driven decision-making is paramount. Relying solely on intuition or outdated methods can lead to missed opportunities. By embracing statistical techniques, professionals can make informed choices that yield better outcomes. Second, continuous improvement is essential. The financial landscape is ever-evolving, and staying updated on the latest statistical methods is crucial. Investing in training and professional development ensures that finance teams remain competitive and knowledgeable. Lastly, collaboration between data analysts and financial experts is vital for maximizing the effectiveness of these statistical methods. Combining expertise creates a powerful synergy that drives innovation and success.

Best Practices for Finance Professionals

Methodology

Implementing statistical methods in financial analysis requires a structured approach. Start by clearly defining objectives. What specific questions do you want to answer? Next, gather relevant data from reliable sources. Ensure the data is clean and well-organized before analysis. Once you have your data, choose the appropriate statistical methods. Regression analysis works well for predicting relationships between variables, while time series analysis is excellent for identifying trends over time. After conducting your analysis, interpret the results in the context of your financial goals. Finally, share your findings with stakeholders to inform decision-making processes.Continuous Learning

In the world of finance, learning never stops. Ongoing education in statistical methods and data analysis technologies is crucial. Many resources are available, from online courses to workshops and professional certifications. Engage with industry experts and participate in conferences to stay ahead of trends. Additionally, encourage a culture of learning within your organization. Foster an environment where team members can share insights and knowledge. This collaborative approach not only enhances individual skills but also strengthens the team’s overall capabilities. Embrace continuous learning, and you’ll be well-equipped to tackle the challenges of the evolving financial landscape.

Conclusion

In the ever-evolving world of finance, statistical methods stand as the backbone of effective decision-making. This guide has taken you through essential statistical techniques, including regression analysis, hypothesis testing, and time series analysis. Each method plays a crucial role in helping finance professionals interpret data, predict trends, and assess risk. To recap, regression analysis aids in understanding relationships between variables, while hypothesis testing provides a framework for validating assumptions. Time series analysis, on the other hand, is vital for forecasting future financial performance based on historical data. These methods empower finance professionals to transform raw data into strategic insights, ultimately guiding investment decisions and risk management. As we look ahead to 2024 and beyond, the landscape of finance will continue to evolve. The integration of big data and advanced analytics will drive the need for more sophisticated statistical techniques. Finance professionals must embrace these changes and adapt their skills accordingly. The role of statistical methods will be pivotal in developing robust financial strategies that align with shifting market dynamics. Moreover, the rise of artificial intelligence and machine learning is reshaping how financial data is analyzed. These technologies will enhance traditional statistical methods, allowing for real-time data processing and more accurate predictions. Finance professionals who harness these advancements will position themselves at the forefront of the industry. In conclusion, as the finance sector adapts to new challenges and opportunities, the importance of statistical methods cannot be overstated. By mastering these techniques and staying updated on emerging trends, finance professionals can navigate the complexities of the financial landscape and contribute to the success of their organizations.

FAQs

What statistical methods should every finance professional know?

Every finance professional should be familiar with a few essential statistical methods. These include: – **Regression Analysis**: This method helps in predicting the value of a dependent variable based on one or more independent variables. For instance, it can forecast stock prices based on various economic indicators. – **Hypothesis Testing**: This technique allows professionals to test assumptions about a population based on sample data. It’s useful for making decisions based on statistical evidence, such as assessing the effectiveness of a new marketing strategy. – **Time Series Analysis**: This method analyzes data points collected or recorded at specific time intervals. It’s crucial for forecasting economic trends and understanding seasonal variations in financial markets.

How can I get started with learning statistical methods?

Getting started with statistical methods is easier than you think! Here are some suggestions: – **Online Courses**: Platforms like Coursera and edX offer courses on statistics tailored for finance professionals. Look for courses that cover regression analysis, time series analysis, and hypothesis testing. – **Certifications**: Consider obtaining certifications in data analysis or financial modeling. These credentials can enhance your resume and provide structured learning. – **Books and Resources**: Explore textbooks on statistics and financial analysis. Look for titles that include practical examples and exercises.

What tools are best for statistical analysis in finance?

Utilizing the right tools can significantly enhance your statistical analysis. Here are some popular tools: – **Excel**: A must-have for any finance professional. Excel offers powerful functions for data analysis, including pivot tables and regression tools. – **R and Python**: Both programming languages are widely used in finance for statistical analysis and data visualization. R is excellent for statistical modeling, while Python is great for automation and handling large datasets. – **Tableau and Power BI**: These visualization tools help present data insights in a user-friendly manner, making it easier for stakeholders to understand complex analyses.

How do I apply statistical methods to real-world financial problems?

Applying statistical methods to financial problems involves several steps: – **Identify the Problem**: Clearly define the financial issue you want to address, such as predicting sales, assessing risk, or optimizing investment portfolios. – **Collect Data**: Gather relevant data from reliable sources. Ensure that the data is clean and well-organized for analysis. – **Choose the Right Method**: Select the appropriate statistical method based on your problem. For example, use regression analysis for forecasting or hypothesis testing for validating assumptions. – **Analyze the Results**: Interpret the outcomes of your analysis, considering their implications for your financial strategies. – **Communicate Findings**: Present your results clearly to stakeholders, highlighting key insights and recommendations.

What are the emerging trends in finance that require statistical knowledge?

Several emerging trends in finance underscore the importance of statistical knowledge: – **Artificial Intelligence and Machine Learning**: These technologies leverage statistical methods to improve decision-making processes and predictive analytics. Finance professionals must understand these tools to stay competitive. – **Big Data Analytics**: The ability to analyze vast amounts of data is becoming essential. Professionals need to be skilled in statistical methods that can handle big data for effective analysis. – **Risk Management**: With increasing market volatility, advanced statistical techniques are crucial in assessing and managing financial risks. Understanding these tools can enhance risk assessment strategies.

All images from Pexels