Introduction

Market breadth is vital for stock market analysis. It shows how many stocks are moving in a direction, indicating overall market health. The S&P 1500 index combines the S&P 500, S&P 400, and S&P 600, making it a crucial tool for investors. Understanding average breadth helps you make smarter investment choices.

Speaking of investment choices, if you’re looking for a solid foundation in investing principles, you might want to check out “The Intelligent Investor” by Benjamin Graham. This book provides timeless wisdom on the art of investing, helping you avoid common pitfalls and build a solid portfolio.

Summary and Overview

Market breadth measures the number of stocks advancing versus those declining. Average breadth specifically assesses this within the S&P 1500 index. A high average breadth suggests strong market momentum and positive investor sentiment. Recent data indicate that many sectors within the S&P 1500 are performing well, reflecting a possible market rebound. Key indicators, like the All Star Charts average breadth, help investors gauge market trends effectively. By keeping an eye on these metrics, you can better anticipate market movements and adjust your strategies accordingly.

Understanding market trends is essential for investors. Learn more about resources for predicting future market trends.

Understanding Market Breadth

What is Market Breadth?

Market breadth gauges the overall health of the stock market. It measures how many stocks are rising versus those that are falling. This indicator plays a vital role in technical analysis. It helps investors see if market movements are broad-based or driven by a few large stocks.

When many stocks are participating in a rally, it signals strength. Conversely, if only a handful of stocks are advancing, it may indicate weakness. By analyzing breadth indicators, investors can assess market trends and potential reversals.

If you’re looking to dive deeper into the psychology behind investing, consider reading “The Psychology of Money” by Morgan Housel. It explores how your mindset can impact your financial decisions, which is crucial for understanding market breadth.

Importance of Average Breadth

Average breadth is a specific metric that smooths out daily fluctuations in market breadth. It’s calculated by averaging the number of advancing stocks over a set period. This gives a clearer picture of market momentum.

Understanding average breadth is crucial for identifying market conditions. A high average breadth often indicates a bullish market, while a low average breadth may suggest bearish conditions. Unlike other indicators, average breadth focuses on the participation of stocks, making it a unique and valuable tool for investors.

Speaking of tools, if you’re serious about tracking your investments, you might need an Investment Portfolio Tracker. This handy tool allows you to manage your investments efficiently and keep track of your performance over time.

Key Indicators of Average Breadth

The S&P 1500 Index

The S&P 1500 index is a comprehensive benchmark. It combines three other indices: the S&P 500, S&P 400, and S&P 600. This blend includes large, mid, and small-cap stocks. With over 1,500 stocks, it offers a diverse view of the market.

Investors rely on the S&P 1500 to track overall market performance. It reflects broader economic trends and investor sentiment. Changes in this index often signal shifts in the market, making it essential for informed decision-making.

If you want to understand the investment principles that can guide your decisions, check out “The Millionaire Next Door” by Thomas J. Stanley. This book reveals the habits and mindsets of the wealthy, providing practical advice for your financial journey.

All Star Charts Average Breadth Indicator

The All Star Charts average breadth indicator measures market participation. It analyzes the number of advancing stocks compared to declining ones. This gives a clearer view of market strength over time.

Interpreting this indicator involves looking at the ratio of advances to declines. High readings suggest a strong market, while low readings indicate weakness. Historically, these trends have indicated crucial turning points in the market.

For instance, when the average breadth consistently remains high, it often precedes bullish trends. Conversely, a decline in breadth may signal an upcoming downturn. Observing these patterns can help investors anticipate market movements and adjust their strategies accordingly.

Analyzing Current Market Conditions

Recent Trends in the S&P 1500

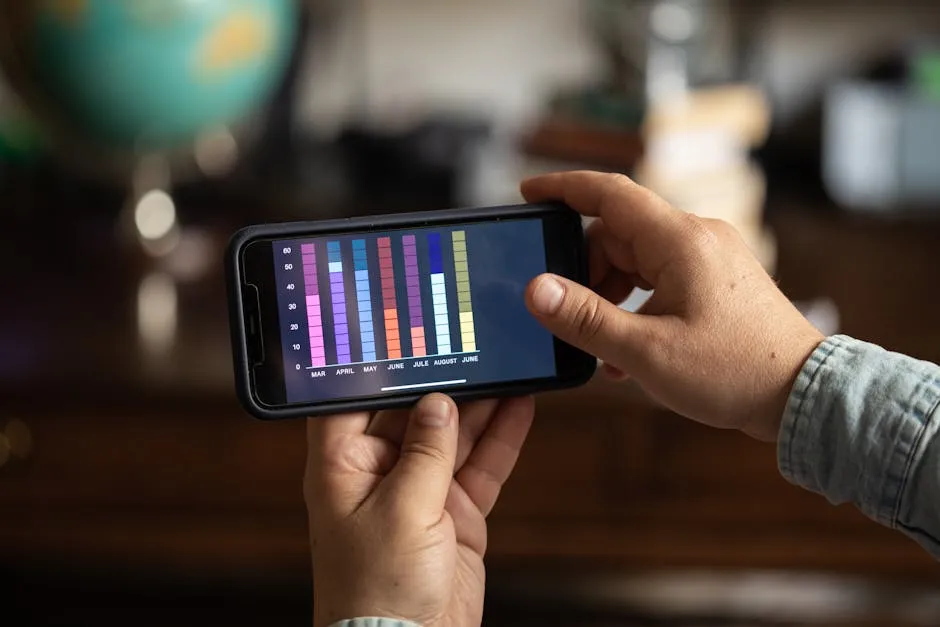

The S&P 1500 has shown some intriguing performance trends lately. Recently, a notable recovery trend began, with many sectors bouncing back. In fact, around 10% of the industries within the S&P 1500 reached new 52-week highs. This resurgence is a significant sign of market vitality.

Analyzing average breadth data reveals crucial insights. When average breadth is high, it often correlates with a healthy market. For instance, when more stocks are advancing than declining, it suggests strong investor confidence. Recent statistics indicate improved breadth, hinting at a potential market rebound.

Charts illustrating these trends show a clear upward trajectory, particularly in sectors like technology and healthcare. Monitoring these indicators can provide valuable context for future market movements.

If you’re eager to expand your investment knowledge, consider picking up “A Random Walk Down Wall Street” by Burton G. Malkiel. This book offers insights into market behavior and investment strategies that can help you navigate the complexities of investing.

Bullish vs. Bearish Breadth

Understanding bullish and bearish breadth is essential for all investors. Bullish breadth occurs when a significant number of stocks advance, typically signaling optimism. On the other hand, bearish breadth indicates more stocks are declining, suggesting pessimism among investors.

Scenarios where breadth shifts can be telling. For instance, if bullish breadth peaks while the market declines, it may signal a potential reversal. Historical examples illustrate this well. In 2019, bullish breadth indicated strong momentum before a market pullback occurred, while bearish breadth in early 2020 foreshadowed a downturn.

Investors should pay attention to these signals. They can guide your decisions on when to enter or exit positions. By analyzing breadth trends, you can better navigate market sentiment and positioning.

Practical Applications for Investors

Making Investment Decisions Based on Breadth

Investors can gain valuable insights from average breadth indicators. These tools help gauge market strength and sentiment. A high average breadth often suggests a good time to buy. Conversely, low average breadth may signal a need to hold or sell.

When average breadth shows consistent strength, it indicates broad participation. This trend can be a sign of a healthy market. If you notice breadth weakening, it may be time to reassess your position. Always consider the context of your investments. Use average breadth as part of a broader strategy, not as the sole indicator.

To help you with your investment strategies, consider using a Financial Calculator. This tool can assist in making quick calculations and projections, ensuring you stay on top of your financial game.

Tools and Resources for Tracking Average Breadth

Several platforms can help you monitor average breadth effectively. Websites like All Star Charts provide valuable data. TradingView also offers tools for tracking market breadth indicators. These resources are essential for making informed decisions.

Combining breadth analysis with other indicators enhances your strategy. For example, look at price movements and volume alongside breadth data. This approach gives a more comprehensive view of market conditions. By integrating these tools, you can better navigate investment opportunities.

And don’t forget about education! For a deep dive into investment philosophies, check out “Common Stocks and Uncommon Profits” by Philip A. Fisher. This classic book provides insights into evaluating stocks that can lead to long-term success.

FAQs

What is market breadth, and why is it important?

Market breadth measures the number of stocks advancing versus declining. It helps investors understand overall market health and sentiment.

How is average breadth calculated for the S&P 1500?

Average breadth is calculated by averaging the number of advancing stocks over a specific period. Data is sourced from stock exchanges.

What does a high average breadth indicate about market conditions?

A high average breadth typically signals bullish market conditions, suggesting strong investor confidence.

How can I use average breadth to improve my investment strategy?

Integrate average breadth analysis with other indicators. Use it to determine optimal entry and exit points in your investments.

Are there any limitations to using average breadth as an indicator?

While useful, average breadth shouldn’t be the only factor in decision-making. Market conditions can change rapidly, so rely on multiple indicators for balance.

Please let us know what you think about our content by leaving a comment down below!

Thank you for reading till here 🙂

All images from Pexels