Introduction

Stock charts are vital in the financial markets. They help traders and investors analyze stock performance. By visualizing data, stock charts reveal trends and patterns. This information allows you to make informed trading decisions. Understanding these tools can significantly enhance your trading strategy.

To dive deeper into stock trading fundamentals, check out Stock Market for Beginners: A Comprehensive Guide to Stock Trading and Investing. It’s the perfect starting point for anyone looking to understand the basics of the stock market.

Summary and Overview

Stock charts are graphical representations of a stock’s price movements over time. They play a crucial role in trading by providing insights into market behavior. Different types of stock charts exist, including line, bar, and candlestick charts. Each type conveys unique information about price trends and trading volume.

Line charts show price movement over time, while bar charts offer more detail with open, high, low, and close prices. Candlestick charts provide even deeper insights, displaying price movement within specific timeframes. Recognizing how to read these charts is essential for successful trading strategies.

Understanding stock charts can help you identify potential entry and exit points. By analyzing trends, you can make better decisions that align with your investment goals. Therefore, mastering stock charts is a critical skill for any trader or investor.

If you’re looking to master the art of charting, consider picking up a copy of Candlestick Charting Explained: Timeless Techniques for Trading Stocks and Futures. This book is a treasure trove of knowledge for both beginners and seasoned traders.

Understanding Stock Charts

What Are Stock Charts?

Stock charts visually represent the price movements of stocks over time. They serve as essential tools for traders and investors. Historically, stock charts have evolved from simple line graphs to complex visualizations. Today, they incorporate advanced features and indicators to aid analysis.

The primary types of stock charts include line, bar, and candlestick charts. Each type serves a specific purpose, providing unique insights into market behavior. Recognizing the differences among these charts is crucial for effective analysis.

Types of Stock Charts

Line Charts

Line charts are the simplest form of stock charts. They plot closing prices over a specific period, connecting the dots with a line. This type of chart helps visualize overall trends but lacks detailed information about price fluctuations.

Bar Charts

Bar charts present more information than line charts. Each bar represents a specific time period, displaying the open, high, low, and close prices. This added detail allows traders to analyze price movements better and identify support and resistance levels.

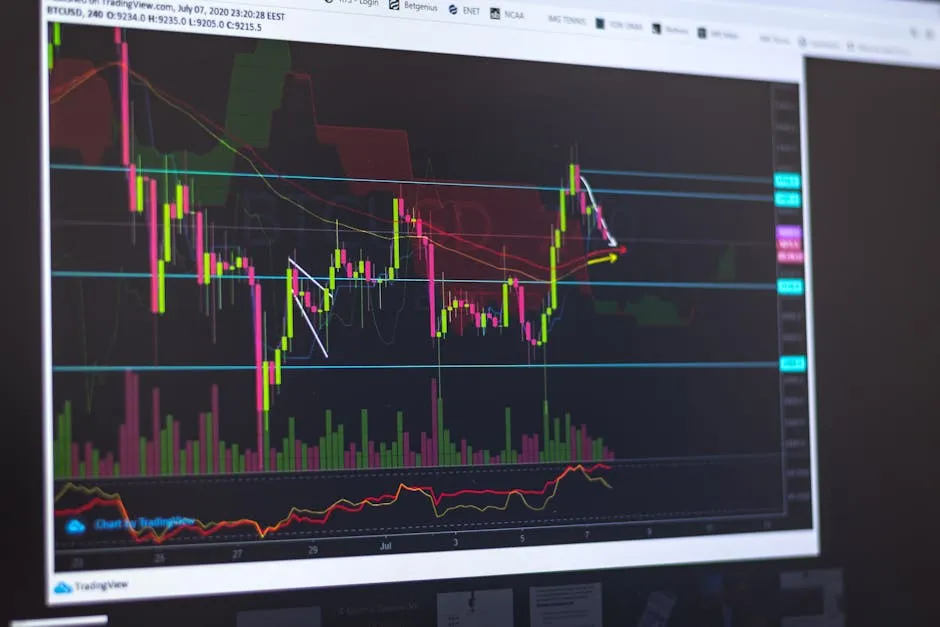

Candlestick Charts

Candlestick charts are popular among traders for their visual appeal and depth of information. Each candlestick shows the open, high, low, and close prices within a given timeframe. The body of the candlestick indicates price movement, while the wicks show the range of price fluctuations. This chart type helps traders recognize patterns and potential reversals.

Area Charts

Area charts are similar to line charts but fill the area below the line with color. This visualization emphasizes the volume of trades and price movements. While they provide a quick overview of price trends, they lack the detailed information found in bar and candlestick charts.

Understanding when to use each type of chart is vital. Line charts are best for quick trend analysis, while bar and candlestick charts provide deeper insights. Area charts can help visualize price movements alongside trading volume. By selecting the right chart type, you can enhance your analysis and trading strategies.

Key Components of Stock Charts

Price Action

Price action refers to the movement of a stock’s price over time. This movement is the foundation for technical analysis. It highlights how prices change and helps traders identify trends. Understanding price action is crucial because it reflects market sentiment. For example, a sharp price increase often indicates strong buying interest. Conversely, a sudden drop suggests selling pressure. By observing these movements, traders can gauge the market’s mood and make informed decisions.

Timeframes

Timeframes are essential when analyzing stock charts. You can view data daily, weekly, or monthly. Each timeframe offers a different perspective. For short-term trading, daily charts are popular. They provide insights into quick price movements. Weekly charts help identify medium-term trends, while monthly charts show long-term patterns. Choosing the right timeframe is vital. It can influence your analysis and trading strategy significantly. Adjust your approach based on the timeframe you select to match your trading style.

Indicators and Overlays

Technical indicators enhance stock chart analysis. Common indicators include moving averages, RSI, and MACD. Moving averages smooth out price data, helping to identify trends. The Relative Strength Index (RSI) indicates overbought or oversold conditions. Meanwhile, the Moving Average Convergence Divergence (MACD) helps identify potential buy and sell signals.

Overlays, such as Bollinger Bands or Fibonacci retracements, add further context. They provide additional layers of information. By using these tools together, traders can gain deeper insights. This combination allows for more informed decisions, increasing the chances of trading success.

How to Read Stock Charts

Basic Chart Patterns

Reading stock charts involves recognizing chart patterns. Common patterns include head and shoulders, double tops, and double bottoms. The head and shoulders pattern often indicates a reversal. It appears after an uptrend and signals a potential price drop. A double top is another reversal pattern, signaling that an asset might be overbought.

Conversely, double bottoms indicate a potential bullish reversal. They appear after a downtrend and suggest that prices may rise. Understanding these patterns can greatly aid traders. By recognizing them early, you can make timely trades. Always look for confirmation through volume or other indicators to validate your analysis.

Trend Lines and Support/Resistance

Trend lines are essential tools in stock analysis. They help visualize the direction of price movements. By connecting the highs or lows of stock prices, you can identify trends. An upward trend line indicates rising prices, while a downward trend line signals falling prices. These lines serve as guides for potential entry and exit points.

Support and resistance levels are also crucial concepts. Support is the price level where a stock tends to stop falling. It acts like a floor, preventing further declines. Resistance, on the other hand, is the level where prices stop rising. It acts as a ceiling, limiting upward movement. To identify these levels, look for price points where the stock reverses direction multiple times. These areas often indicate strong buying or selling interest.

Volume Analysis

Trading volume provides valuable insights into market activity. It represents the number of shares traded during a specific period. High volume often confirms the strength of a price movement. For example, if a stock breaks through resistance with high volume, it signals strong momentum. Conversely, if a stock rises on low volume, it may indicate a lack of conviction.

Volume can also validate chart patterns, like breakouts or reversals. When you see a significant price movement accompanied by high volume, it suggests the trend is likely to continue. Traders often use volume indicators, such as On-Balance Volume (OBV), to enhance their analysis. This helps provide a clearer picture of market sentiment and potential future movements.

Advanced Charting Techniques

Technical Analysis Strategies

Technical analysis strategies involve using stock charts to predict future price movements. Various techniques exist, such as trend following, momentum trading, and mean reversion. Trend following focuses on identifying established trends and riding them. Momentum trading aims to capitalize on stocks moving quickly in one direction. Mean reversion, on the other hand, assumes that prices will return to their average over time.

Combining multiple indicators enhances your analysis. For instance, using moving averages along with RSI can provide a more comprehensive view. This combination helps confirm signals and reduces false positives. By layering analysis techniques, you create a robust strategy for making informed trading decisions.

Charting Software and Tools

Several popular charting software options cater to different trading styles. TradingView Charting Software stands out with its user-friendly interface and extensive features. It offers a wide range of indicators and customizable chart types. StockCharts Subscription is another excellent choice, known for its powerful analysis tools. It provides advanced features like market scans and alerts, helping traders stay ahead.

Both platforms enable traders to visualize data effectively. They also allow for real-time updates, which is crucial for active trading. Additionally, many tools offer mobile compatibility, so you can analyze charts on the go. Choosing the right software can enhance your trading experience and improve your decision-making process.

Customizing Your Charts

Customizing your stock charts can significantly improve your analysis. Start by selecting color schemes that appeal to you. A well-chosen color palette can enhance clarity and reduce visual strain. Consider using contrasting colors for different indicators. This makes it easier to distinguish between price movements and trends.

Layout is just as important. Most charting software allows you to adjust the arrangement of your charts. You can choose between single and multi-chart layouts. Multi-chart layouts can help you analyze multiple stocks or timeframes simultaneously. This flexibility can lead to better insights.

Personalization is key in chart analysis. When charts resonate with your aesthetic preferences, you’re more likely to engage with them. This engagement helps you spot trends and patterns that may otherwise go unnoticed. Ultimately, a personalized chart setup can enhance your trading confidence.

Practical Applications of Stock Charts

Developing a Trading Plan

Stock charts play a crucial role in shaping effective trading strategies. They provide visual data that can inform your decisions. Begin by analyzing historical price movements. Identify trends and patterns that indicate potential future movements. Use this information to set entry and exit points for your trades.

When developing a trading plan, include specific guidelines. Define your risk tolerance and potential reward targets. For example, consider using stop-loss orders to limit potential losses. This protects your investments from unexpected market shifts. Additionally, set realistic goals based on your analysis of stock charts.

Regularly review and adjust your trading plan. Markets are dynamic, and staying flexible is essential. Use your charts to monitor performance and make necessary changes. This adaptability increases your chances of success in the trading arena.

For a comprehensive approach to trading, consider How to Make Money in Stocks: A Winning System in Good Times and Bad by William J. O’Neil. It’s packed with strategies that can help you navigate the complexities of the stock market.

Case Studies and Examples

Let’s look at real-world examples of successful trades based on chart analysis. One notable case involved a trader who identified a bullish flag pattern on a stock chart. This pattern often indicates a continuation of an upward trend. The trader entered the position, capitalizing on the breakout that followed.

Another example features a trader who utilized moving averages. By observing the crossover of short-term and long-term moving averages, they identified a buy signal. This strategy helped them ride the upward momentum and secure profits.

Both cases highlight the importance of recognizing patterns and signals on stock charts. Successful trades often stem from informed decisions grounded in analytical data. By studying these examples, you can develop your own strategies and improve your trading success.

Conclusion

Stock charts are essential for trading and investing success. They provide valuable insights into stock performance and market trends. By mastering chart analysis, you can make informed decisions and enhance your trading strategies. Don’t hesitate to practice your skills and familiarize yourself with various tools and techniques. The more you learn, the better equipped you’ll be to navigate the financial markets confidently. So, grab your charts and start analyzing!

For those looking for further reading on investment principles, The Intelligent Investor by Benjamin Graham is a classic that offers timeless advice on investing.

FAQs

What are the most common types of stock charts?

The most common types of stock charts are: 1. **Line Charts**: These charts display closing prices over time. They help visualize overall trends but offer limited details on price fluctuations. 2. **Bar Charts**: Bar charts provide more information than line charts. Each bar shows open, high, low, and close prices for a specific time period. This added detail is useful for identifying price movements. 3. **Candlestick Charts**: Popular among traders, these charts depict price movement within a timeframe. Each candlestick shows the open, high, low, and close values, helping traders identify patterns and potential market reversals. 4. **Area Charts**: Similar to line charts, area charts fill the space below the line with color. They emphasize volume and price movements, offering a quick visual overview.

How do I choose the right timeframe for my stock charts?

Choosing the right timeframe depends on your trading style and goals. Short-term traders often use daily or hourly charts for quick price movements. Swing traders may prefer daily or weekly charts to identify medium-term trends. Long-term investors typically use monthly charts to spot overall market direction. Consider your strategy and how much time you can dedicate to monitoring your trades when selecting a timeframe.

Can I use stock charts for cryptocurrencies?

Yes, stock charts can be used for cryptocurrencies. Many charting techniques and indicators apply to both stock and cryptocurrency markets. However, remember that cryptocurrencies can be more volatile than traditional stocks. This volatility may affect your analysis and trading strategies. Always stay updated on market trends and be prepared for rapid price fluctuations.

What are some free resources for learning about stock charts?

Several free resources can help you learn about stock charts: – **Investopedia**: Provides articles and tutorials on stock chart basics and analysis techniques. – **Yahoo Finance**: Offers access to stock charts and educational materials for beginners. – **TradingView**: Features a community-driven platform with tutorials and charting tools. – **YouTube**: Numerous channels provide video tutorials on reading and interpreting stock charts. – **Reddit**: Subreddits like r/stocks and r/investing offer discussions and resources from experienced traders.

How can I improve my skills in reading stock charts?

Improving your chart-reading skills involves practice and education. Here are some tips: – **Study Chart Patterns**: Familiarize yourself with common chart patterns and their implications, like head and shoulders or double tops. – **Use Demo Accounts**: Practice trading with virtual money to apply your skills without financial risk. – **Follow Market News**: Stay informed about market trends and news that may affect stock prices. – **Join Online Communities**: Engage with other traders to share insights and learn from their experiences. – **Attend Webinars**: Participate in webinars to gain knowledge from experts in stock chart analysis.

What software is recommended for beginners?

For beginners, user-friendly charting software options include: – **TradingView**: Known for its intuitive interface and extensive features, suitable for all skill levels. – **StockCharts**: Offers a variety of tools and resources for analyzing stock charts effectively. – **Yahoo Finance**: Provides basic charting features and market data, great for beginners. – **Thinkorswim**: A comprehensive trading platform with advanced charting tools and educational resources.

How do I integrate stock charts into my trading strategy?

Integrating stock charts into your trading strategy is crucial. Start by using charts to identify trends and patterns that align with your trading goals. Set clear entry and exit points based on chart analysis. Combine chart insights with other tools, like fundamental analysis and market news, to create a well-rounded strategy. Regularly review your performance and adjust your approach based on what works best for you. By consistently using charts in your strategy, you can enhance your decision-making and improve your trading outcomes.

Please let us know what you think about our content by leaving a comment down below!

Thank you for reading till here 🙂

For those interested in the statistical aspects of market behavior, check out the university of minnesota statistics resources for predicting future market trends.

All images from Pexels