Introduction

Beneficial Ownership Information (BOI) reporting is crucial for Massachusetts businesses. This requirement stems from the Corporate Transparency Act (CTA), aimed at increasing transparency and combating financial crimes. Compliance is essential, especially with deadlines approaching. Failing to meet these deadlines can lead to hefty penalties. To understand the ins and outs, consider checking out The Corporate Transparency Act: A Guide for Business Owners. This book is a must-read for any business owner looking to navigate the murky waters of compliance without drowning in paperwork.

Summary and Overview

Beneficial Ownership Information refers to details about individuals who own or control a company. This reporting is vital in the fight against money laundering and tax evasion. The Corporate Transparency Act mandates that specific entities disclose their beneficial ownership to the Financial Crimes Enforcement Network (FinCEN). In Massachusetts, this affects many businesses, including corporations and LLCs. However, some entities, like publicly traded companies, are exempt from filing. Understanding these requirements is essential for compliance. In the sections ahead, we’ll cover filing requirements, compliance strategies, and best practices to help you navigate this new landscape. For more insights, grab a copy of the Financial Crimes Enforcement Network (FinCEN) Compliance Manual. It’s like having a compliance coach in your corner!

Understanding BOI Reporting in Massachusetts

What is Beneficial Ownership Information?

Beneficial Ownership Information (BOI) highlights individuals who own or control a company. This includes anyone with at least 25% ownership or significant control over a business. The significance of BOI reporting lies in promoting financial transparency. By revealing the true owners behind companies, it helps prevent financial crimes, such as money laundering and tax evasion. Many countries have adopted transparency laws to combat these issues. Therefore, understanding and complying with BOI reporting is vital for businesses in Massachusetts. It not only ensures regulatory adherence but also fosters trust within the community and among stakeholders. If you’re looking for a deeper understanding of financial misconduct, consider Money Laundering: A Guide for Criminal Investigators. It’s packed with insights that can help you stay ahead of potential pitfalls.

Who Needs to File BOI Reports?

In Massachusetts, various entities must file BOI reports under the Corporate Transparency Act (CTA). This includes most corporations, limited liability companies (LLCs), and other entities formed by filing documents with the Secretary of State. Publicly traded companies and certain regulated entities are exempt from these requirements. Interestingly, there are around 23 categories of exemptions outlined by the CTA. Statistics indicate that thousands of businesses in Massachusetts will be affected by these new rules, as they seek to enhance transparency in ownership structures. Understanding who needs to file and the exemptions is crucial for compliance and avoiding potential penalties. To further your knowledge on compliance, check out The Complete Guide to Business Compliance. It’s like your compliance GPS!

How to Identify Beneficial Owners

Definition of a Beneficial Owner

A beneficial owner is someone who holds at least 25% of ownership or exerts substantial control over a business. This includes individuals who make significant decisions or influence company operations. Ownership interests can range from shares of stock to voting rights. Understanding who qualifies as a beneficial owner is essential for meeting reporting requirements. Accurate identification helps prevent financial crimes and ensures compliance with regulations.

Steps to Identify Beneficial Owners

Identifying beneficial owners involves a straightforward process. Start by reviewing your company’s ownership structure. Gather information about individuals with significant control or ownership interests. This includes names, addresses, and identification details. Keep thorough records to ensure compliance with reporting requirements. Accurate documentation is crucial for maintaining transparency and fulfilling legal obligations. Regularly update this information to reflect any changes in ownership or control. Engaging with legal experts can also clarify complex ownership scenarios and enhance your compliance efforts. For a comprehensive understanding of business law, consider reading Business Law: Text and Cases. It’s a great resource for understanding the legal landscape!

Filing BOI Reports in Massachusetts

Filing Process Overview

Filing a Beneficial Ownership Information (BOI) report in Massachusetts is crucial for compliance. Here’s a step-by-step guide to make it easier for you:

- Identify Beneficial Owners: Start by determining who qualifies as a beneficial owner. This includes anyone who owns at least 25% of the company or exerts significant control.

- Gather Required Information: Collect essential details of both your beneficial owners and the company. You’ll need their full names, addresses, dates of birth, and government-issued ID numbers. This ensures accuracy in your BOI report submission.

- Prepare the Report: Use the information collected to fill out the BOI report. Ensure you follow the specific format required by the Financial Crimes Enforcement Network (FinCEN).

- Submit the Report: Once your report is complete, submit it electronically through FinCEN’s secure filing system. Double-check your information before you hit “submit” to avoid any mistakes.

- Stay Updated: Keep your records current. If there are any changes in your ownership structure, file an updated report within 30 days.

By following these steps, you can navigate the filing process smoothly. Remember, staying organized and proactive will help you meet your compliance obligations effectively. For an in-depth look into compliance management, check out Compliance Management: A How-To Guide for Executives. It’s a valuable tool for any business leader!

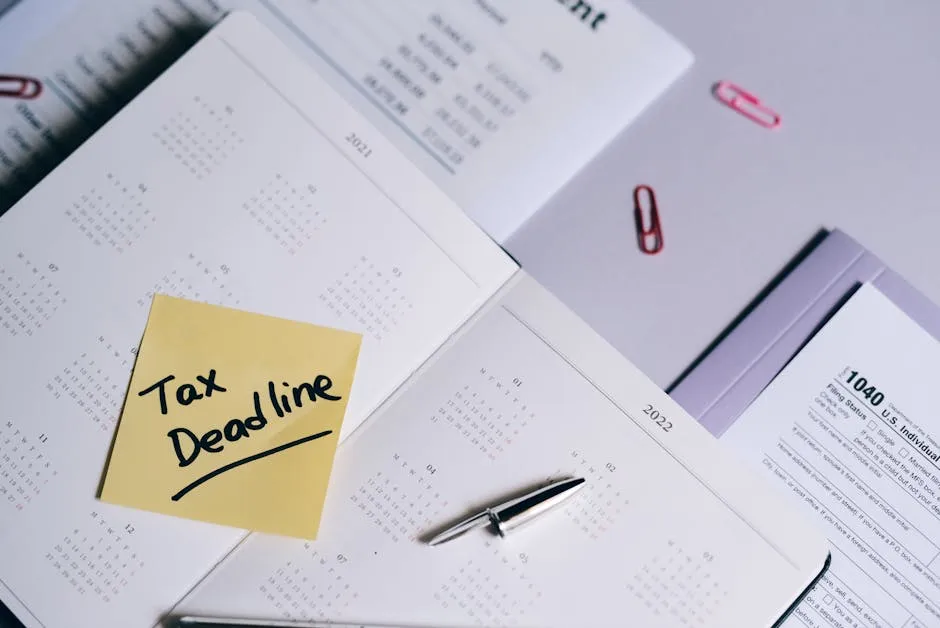

Deadlines for Filing

Timely filing of BOI reports is essential for all businesses in Massachusetts. Here are the key deadlines you should be aware of:

- For Existing Entities: Companies formed before January 1, 2024, must file their initial BOI report by January 1, 2025.

- For New Entities: If your company is formed on or after January 1, 2024, you need to submit your BOI report within 90 days of formation.

- Post-2024 Entities: Newly formed companies after January 1, 2025, must file their initial report within 30 days.

Adhering to these filing deadlines is crucial. Missing them can result in daily penalties, potentially amounting to significant fines. Make sure to mark these dates on your calendar to avoid any compliance issues. For a more thorough understanding of tax compliance, consider reading The Tax Compliance Handbook. It’s a great resource for understanding the intricacies of tax regulations!

Consequences of Non-Compliance

Failing to file your BOI report or submitting false information can have serious repercussions. Here’s what you need to know:

- Civil Penalties: Companies may face fines of up to $500 per day for non-compliance.

- Criminal Penalties: Severe cases can lead to imprisonment for up to two years and fines reaching $10,000.

Understanding these penalties is vital for your business. Non-compliance not only jeopardizes your company’s reputation but can also result in legal consequences that affect your operations. Staying compliant with BOI reporting is essential for avoiding these risks. For further insights into business law, check out Business Law and the Regulation of Business. It’s a solid resource to ensure you’re on the right side of the law!

Best Practices for Compliance

Tips for Maintaining Compliance

Keeping your Beneficial Ownership Information (BOI) up to date is crucial. Regularly review and update ownership details to reflect any changes. This practice ensures you remain compliant with the Corporate Transparency Act (CTA).

Don’t hesitate to consult legal experts, especially for complex ownership structures. Their insights can clarify any uncertainties, preventing potential pitfalls. Legal consultation can save your business time and money in the long run. For a comprehensive guide on business ethics, consider reading Business Ethics: A Stakeholder and Issues Management Approach. It’s essential for aligning your business practices with ethical standards!

Incorporate compliance tips into your routine. Set reminders to check your ownership information periodically. This proactive approach helps avoid last-minute scrambles when deadlines approach. Stay informed about any changes in reporting requirements to ensure your business remains compliant.

Resources for Assistance

Navigating BOI reporting can feel overwhelming, but numerous resources are available to help. Various tools and services can assist you in filing your BOI report accurately and timely. Look for reputable online platforms specializing in BOI compliance; they can streamline the process significantly. For office organization, consider a Desk Organizer for Office Supplies. A tidy desk leads to a tidy mind!

Organizations like the American Institute of CPAs (AICPA) provide valuable guidance and resources. They often host webinars and provide updates on compliance best practices. Additionally, state CPA societies can offer localized support tailored to Massachusetts businesses.

Utilizing these resources not only simplifies filing but also boosts your confidence in meeting regulatory requirements. Don’t hesitate to reach out for guidance; staying informed is key to successful compliance. And while you’re at it, why not grab a Wireless Office Printer? It’s a game-changer for any office!

For effective compliance, consider following best practices for using Israel Central Bureau of Statistics data visualization.

Conclusion

BOI reporting is vital for businesses in Massachusetts. Compliance protects your company from penalties and enhances transparency. Take proactive steps to understand your reporting obligations and stay informed about changes. Seek legal advice or use filing services to ensure you meet all requirements efficiently. Your commitment to compliance will foster trust with stakeholders and the community. And before you go, don’t forget to check out The Business Owner’s Guide to Financial Statements. It’s a fantastic resource for understanding your business’s financial health!

Please let us know what you think about our content by leaving a comment down below!

Thank you for reading till here 🙂

All images from Pexels