Introduction

Managing cash flow can feel like riding a roller coaster—full of ups and downs. But fear not! A twelve-week cash flow forecast spreadsheet is your trusty harness, keeping you secure. This tool is vital for anyone navigating the often unpredictable waters of business finance. With a well-structured forecast, you can anticipate cash inflows and outflows, ensuring you’re never caught off-guard. Picture this: you’re a small business owner, juggling bills, sales projections, and unexpected expenses. Suddenly, you find yourself in a cash crunch. Panic sets in. But wait! With our twelve-week cash flow forecast spreadsheet, you can breathe easy. This Excel template is designed to help you maintain control over your financial ship, allowing you to plan for the future while avoiding potential pitfalls. You can also enhance your Excel skills with Excel 2021 for Dummies, making it easier to navigate complex spreadsheets! What’s even better? You can download this customizable template for free! This means you can tailor it to suit your unique business needs, whether you’re running a cozy café or a bustling e-commerce store. The template provides a structured way to input your expected income and expenses, giving you a clear picture of your financial landscape. Think of it as your financial compass, guiding you towards profitability and sustainability. Understanding your cash flow isn’t just a nice-to-have; it’s essential for survival. A well-prepared forecast can help you identify shortfalls before they happen, allowing you to make informed decisions. You’ll be able to see when to invest in new inventory, pay your suppliers, or even hire additional staff—all crucial for growth. So, let’s jump into the details of cash flow forecasting and see how this simple spreadsheet can revolutionize your financial planning. In this guide, we’ll walk you through the ins and outs of cash flow forecasting. From downloading your template to mastering the art of inputting data, we’ve got you covered. You’ll learn how to anticipate your cash needs effectively and manage your resources wisely. With our friendly guidance, you’ll become a cash flow forecasting pro in no time! Ready to set sail on your financial journey? Download your free twelve-week cash flow forecast spreadsheet today and steer your business towards success!

Understanding Cash Flow Forecasting

What is a Cash Flow Forecast?

A cash flow forecast is an estimate of your business’s cash inflows and outflows over a specified period. Think of it as a financial crystal ball, allowing you to predict when cash will flow in or out of your business. Unlike profit and loss statements, which focus on overall profitability, cash flow forecasts provide a real-time view of your liquidity. They show not just how much you earn, but when you can expect to receive money and when obligations are due. This is vital for ensuring you can cover daily expenses and plan for future investments.Importance of Cash Flow Forecasting

Cash flow forecasting is crucial for maintaining liquidity. Imagine running a marathon without knowing how far you’ve gone. That’s what managing a business without a cash flow forecast feels like! By anticipating shortfalls, you can avoid costly surprises. This tool aids decision-making, ensuring you have the resources to invest, hire, or pay off debts. It stabilizes your financial footing, allowing you to focus on growth instead of scrambling for funds. You might also want to consider The Cash Flow Management Book for Nonprofits for deeper insights!Overview of a Twelve-Week Cash Flow Forecast

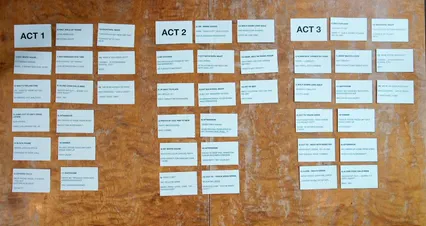

The twelve-week cash flow forecast focuses on a short-term horizon, which offers several advantages. First, it allows for more precise predictions; shorter timeframes mean fewer variables to consider. This duration is particularly beneficial for businesses that experience fluctuating cash flows. Typically, a twelve-week forecast includes sections for cash receipts and disbursements. Cash receipts track expected income, such as sales or loans, while disbursements capture all outflows, including rent, utilities, and payroll. Additionally, you should include assumptions about your business environment, like seasonal sales spikes or anticipated expenses. These projections create a comprehensive view of your financial health over the upcoming three months, guiding your strategic decisions effectively. For those looking to dive deeper into financial management, Financial Intelligence: A Manager’s Guide to Knowing What the Numbers Really Mean is a fantastic read!

Building a Twelve-Week Cash Flow Forecast in Excel

Step 1: Downloading the Template

First things first, you need to snag that free Excel template! Head over to a reliable site where you can find cash flow forecast templates, like Template.net or Smartsheet. Look for the 12 Week Cashflow Forecast Template and click on the download button. It should be in Excel format, making it easy to customize. Once downloaded, locate it in your computer’s Downloads folder. Trust me, it’s the best freebie since sliced bread!Step 2: Setting Up Your Spreadsheet

Now that you have your template, it’s time to set it up based on your business type. Open your Excel file and take a moment to familiarize yourself with the layout. Most templates will have separate sections for cash receipts, cash disbursements, and a summary. If you run a café, ensure the sales projections reflect your busy weekend rushes. For an e-commerce store, consider seasonal trends. Adjust the rows and columns as necessary to fit your specific needs. Remember, this template is your canvas; paint it with figures that tell your unique financial story! You might also want to check out Microsoft Office Home & Student 2021 to ensure you have the best tools at your disposal!

Step 3: Inputting Data

Cash Receipts

Let’s talk about cash receipts. This is the fun part—inputting expected income! Start by entering your anticipated sales figures. Check your sales forecast and include any expected cash inflows from loans or investments. Don’t forget those occasional side hustles—every penny counts! Be realistic; consider historical data and seasonal patterns. If you had a fantastic last quarter, reflect that in your projections. Consistency is key here to ensure your forecast paints a true picture. Have you ever thought about a more comprehensive approach? The Complete Guide to Cash Flow Forecasting could really help!

Cash Disbursements

Next up are cash disbursements. This is where you list all expected expenses—think rent, utilities, payroll, and every little cost that keeps your business running. Be thorough! Include both fixed costs, like your monthly rent, and variable costs, such as marketing expenses that might fluctuate. You can even categorize your expenses for better visibility. This helps you see where your cash is going and identify areas to cut back if needed. Don’t forget to explore The Personal Finance Playbook: A Guide to Cash Flow Management for more strategies!

Adjusting for Assumptions

Now, let’s discuss assumptions. These are the “what ifs” that can make or break your cash flow forecast. For instance, if you anticipate a busy season, adjust your sales projections accordingly. Or if you’re planning a big marketing push, factor in those added costs. Make sure to note these assumptions in your spreadsheet. It provides context for your numbers and helps you track how accurate your forecasts are as time goes on. Remember, forecasting is as much art as it is science! Speaking of science, Financial Forecasting for Your Business can give you a solid foundation!

Step 4: Analyzing Your Forecast

Alright, you’ve inputted your data—now what? It’s time to analyze your forecast! Start by interpreting the data. Look for trends, such as periods of expected cash shortages or surpluses. This insight is invaluable for making strategic decisions, like when to invest in inventory or hold off on hiring. Don’t forget to compare projected versus actual cash flow. This is where the magic happens! By tracking discrepancies between what you forecasted and what actually happened, you can refine your future forecasts. Learn from the past, adjust your assumptions, and keep improving your forecasting skills. To help with this, you might want to check out The Total Money Makeover: A Proven Plan for Financial Fitness to get inspired!

Best Practices for Cash Flow Management

Regular Updates

Updating your cash flow forecast regularly is crucial. Think of it as watering a plant; without consistent care, it withers. A static spreadsheet can quickly become outdated, leading to poor financial decisions. Set a routine for updates—weekly or bi-weekly works wonders! This helps you catch discrepancies early and adjust your plans accordingly. When changes occur—like unexpected expenses or a sudden sales boost—reflect them in your forecast. This agility can save you from cash flow crises. For instance, if your café suddenly has a record weekend, adjust your projections to ensure your finances match reality. Staying on top of your forecast means you’re always prepared for whatever comes your way. You might also find The Lean Startup: How Today’s Entrepreneurs Use Continuous Innovation to Create Radically Successful Businesses a great resource for staying innovative!

Scenario Planning

Scenario planning is your safety net. What happens if sales drop unexpectedly? Or if a big client pays late? Preparing for different scenarios—best-case, worst-case, and everything in between—allows you to strategize effectively. Start by outlining potential scenarios based on historical data. For example, if your business experiences a seasonal dip, plan for it. Create separate forecasts for different situations. This way, you can visualize your cash needs and make informed decisions. Also, consider external factors such as economic shifts or industry trends. Having a game plan for various scenarios will give you confidence and clarity, ensuring that you’re ready to tackle challenges head-on. If you’re looking for practical advice, Cash Flow: A Guide for Small Business Owners is a must-read!

Customization of Templates

Your business is unique, and so should be your cash flow template. While a generic model is a good starting point, customization is where the magic happens. Tailor the template to fit your specific needs, whether you run a boutique, a tech startup, or a food truck. Consider the unique cash inflows and outflows specific to your business. If you have variable costs, like seasonal staff, ensure your template captures these fluctuations. Add or remove categories to reflect your operations accurately. This not only enhances accuracy but also makes the forecast more relevant to your decision-making process. To help with this, Excel Basics in 30 Minutes is a great resource! Take advantage of built-in features in Excel templates. Automate calculations to minimize manual work and reduce errors. The more personalized your template, the clearer your financial picture will be!

Utilizing Additional Resources

Great tools enhance your cash flow management strategy. In addition to your twelve-week cash flow forecast spreadsheet, consider leveraging other resources. Financial management software like QuickBooks Desktop Pro 2021 can integrate seamlessly with your forecasts, providing real-time insights. Explore additional cash flow forecasting templates available online. Websites like Template.net offer a variety of options tailored for different industries. They can save you time and provide new perspectives on how to structure your forecasts. Lastly, educate yourself! Online courses, webinars, and articles on financial management can deepen your understanding of cash flow dynamics. Knowledge is power, and the more you learn, the better decisions you can make for your business. You might also want to read The E-Myth Revisited: Why Most Small Businesses Don’t Work and What to Do About It for crucial insights!

Conclusion

In conclusion, mastering your cash flow forecasting is essential for the longevity of any business. By utilizing the twelve-week cash flow forecast spreadsheet, you can gain insights into your financial health, anticipate challenges, and make informed decisions. Regular updates keep your forecast relevant, while scenario planning prepares you for surprises that could otherwise derail your business. Customizing your template ensures it fits your specific needs, making the forecasting process smoother. You might also consider The Richest Man in Babylon for timeless financial wisdom! Don’t forget to utilize additional resources that can complement your efforts. From specialized software to online courses, these tools can enhance your cash flow management strategy. Remember, the key to successful cash flow management lies in regular updates and adaptability. Download your free template today and take the first step towards financial clarity and success! Your business deserves it!

FAQs

What is the difference between cash flow forecasting and budgeting?

Cash flow forecasting and budgeting might sound like twins separated at birth, but they each have distinct personalities! Cash flow forecasting is all about predicting the cash that will flow in and out of your business over a specific period. Think of it as your financial weather report—sunny days ahead or stormy skies? On the other hand, budgeting is more like a financial roadmap. It outlines your planned revenues and expenses for a period, guiding you on how to allocate your resources. While forecasting looks at the future’s cash availability, budgeting focuses on how to spend it wisely. Together, they make a dynamic duo! Cash flow forecasts help you anticipate needs, while budgets ensure you stick to your financial goals. By using both, you can navigate your finances like a pro, avoiding those nasty cash flow surprises!

How often should I update my cash flow forecast?

Updating your cash flow forecast is crucial, but how often is enough? The answer depends on the size and type of your business. For small businesses with fluctuating sales, a weekly update can keep you in the loop. It’s like checking your heart rate; you want to stay aware of any sudden changes! For medium to larger businesses, monthly updates might suffice. This gives you a broader view while still allowing for adjustments. If your business experiences seasonal fluctuations, consider adjusting your forecast before peak times to reflect those changes. In short, the key is to find a rhythm that works for you. Frequent updates keep your forecast accurate and relevant, ensuring you can react swiftly to unexpected financial shifts. So, keep that spreadsheet fresh!

Can I use the cash flow forecast template for personal finances?

Absolutely! That twelve-week cash flow forecast template you’re itching to use isn’t just for businesses; it’s versatile enough for personal finances too! Think of it as a financial Swiss Army knife. You can adapt the template to track your personal income and expenses, helping you visualize how much cash you have at your disposal. Whether you’re paying off student loans, saving for a vacation, or just trying to get a handle on your monthly bills, this template can serve you well. Customize the income section to include your salary, side gigs, or any passive income. Then, track expenses like rent, groceries, and entertainment. You’ll gain insights into your spending habits and find areas to cut back, all while mastering your financial flow. So go ahead, make it your own!

What if my actual cash flow differs significantly from my forecast?

Uh-oh! If your actual cash flow differs from your forecast, don’t panic. This is your opportunity to learn and adjust. First, analyze what went wrong. Did a major client pay late? Or perhaps your sales were lower than expected? Once you pinpoint the discrepancies, it’s time to tweak your forecast. Update your assumptions based on the latest data. If you notice a pattern, like seasonal dips, incorporate that into your next forecast. This will help you create a more realistic projection moving forward. Additionally, consider establishing a cash reserve to cover unexpected shortfalls. Think of it as your financial cushion; it’ll make those bumps in the road a lot less jarring. With a proactive approach, you’ll not only manage discrepancies but also strengthen your forecasting skills for the future!

For effective cash flow management, consider exploring the best practices for using Israel Central Bureau of Statistics data visualization to enhance your financial strategies.

All images from Pexels